🗽The New Declaration of Independence

How Bitcoin Delivers the Liberty We Lost

My Fourth of July Manifesto for Financial Sovereignty in 2025

On July 4, 1776, a group of revolutionaries signed more than a declaration—they signed a rebuke of centralized power. The American Revolution wasn’t just political. It was philosophical. It was financial.

Nearly 250 years later, many Americans are waking up to a new truth: the systems that claim to preserve our freedoms may, in fact, be eroding them.

From the Federal Reserve’s unchecked monetary policy to digital platforms that track and monetize every click, power has consolidated again—this time not under a king, but under algorithms and unelected bureaucracies.

It’s time for a new kind of independence. One built not with muskets or parchment, but with code.

🔗 FINANCIAL CONTROL: THEN AND NOW

The American colonies didn’t just revolt over taxes. They revolted over money.

The “Continental” currency issued during the Revolutionary War quickly collapsed in value. The phrase “not worth a Continental” became shorthand for the dangers of fiat money—unbacked paper printed without restraint.

The Founding Fathers saw this firsthand. In response, they wrote monetary discipline into the Constitution:

Only gold or silver could be legal tender

States were banned from issuing fiat currency

Inflation, to them, was a form of theft—slow, silent, and corrosive

John Adams wrote that debasing currency was equivalent to stealing from the public. Thomas Jefferson warned that if banks gained control over our money, they would “deprive the people of all property.”

Now look around.

In 2025, the dollar is no longer backed by gold. The Federal Reserve can create trillions in emergency liquidity. Inflation eats away at savings. Most Americans have little understanding—or control—of how the system works.

Freedom has been redefined… and diminished.

⚡ ENTER THE BLOCKCHAIN

In 2009, amidst the rubble of the global financial crisis, a pseudonymous developer named Satoshi Nakamoto proposed a new idea: a peer-to-peer electronic cash system that required no central authority.

Bitcoin was born.

It’s not just digital money. It’s money that obeys no central bank, no politician, no printing press. Its supply is capped at 21 million, its issuance is governed by code, and its ledger is maintained by a decentralized network of nodes around the world.

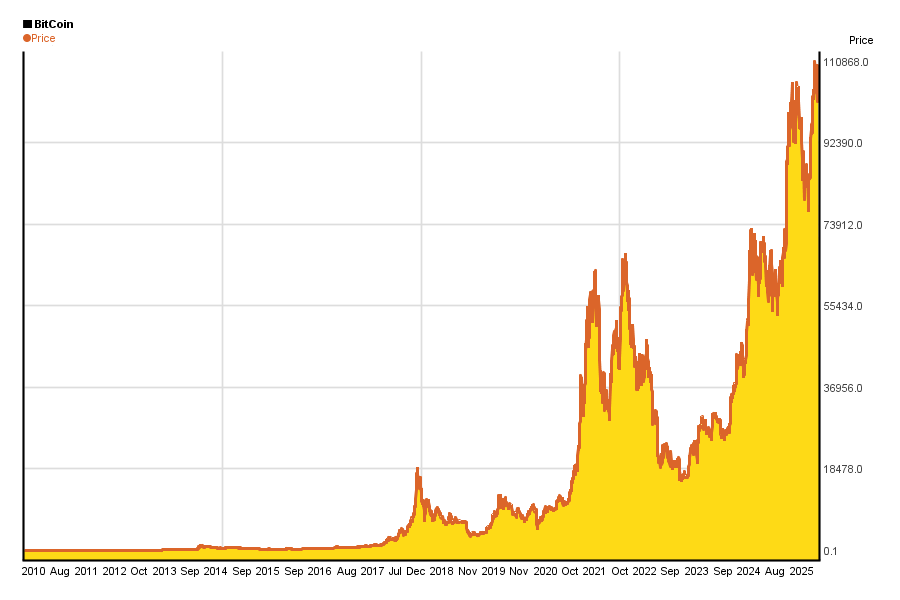

Bitcoin is also the greatest performing financial asset of the modern era. Since inception, it has outpaced every other asset class—including gold, real estate, and equities. Even after market corrections, it has shown a historic ability to recover, stabilize, and deliver long-term exponential growth. Its compound annual growth rate over more than a decade exceeds 200%, and no other investment vehicle—regulated or otherwise—has matched it in both return and resilience. Bitcoin’s total return since inception exceeds 10,000,000%—a number so large it breaks traditional financial logic and reframes what long-term wealth creation even looks like.

Saifedean Ammous, author of The Bitcoin Standard, called it “the first example of absolute scarcity.” Unlike fiat, Bitcoin can’t be inflated or manipulated by design.

So, while Bitcoin is undeniably a philosophical shift toward individual sovereignty, it is also a powerful store of value—a digital foundation for generational wealth and economic independence.

It’s not speculative tech. It’s monetary sovereignty. And it’s working.

🇺🇸 IF THE FOUNDING FATHERS WERE ALIVE TODAY…

They’d run nodes. They’d write whitepapers. They’d fight for protocol governance.

Writers like Robert Breedlove and Marty Bent have noted how deeply aligned Bitcoin is with the original American ideals.

Imagine Thomas Jefferson reading the Bitcoin whitepaper—a system built to resist centralized interference, immune to manipulation, owned by no one and available to everyone.

He’d call it revolutionary.

Ben Franklin would recognize its emphasis on freedom of exchange and community-led innovation. George Washington, weary of tyranny, would see it as a digital fort against control.

In truth, the Founders wouldn’t just own Bitcoin—they’d evangelize it.

They would see it as a new Declaration of Independence, written in code.

💡 LIFE, LIBERTY, AND THE PURSUIT OF SELF-CUSTODY

Let’s return to that founding phrase: life, liberty, and the pursuit of happiness.

These ideals sound poetic, but they’re grounded in something very real: economic agency.

If you can’t control your labor, your time, or your money… are you truly free?

Blockchain, and Bitcoin especially, reintroduces that freedom:

You own your assets—no bank can freeze them

You control your identity—no institution can revoke it

You participate globally—without permission or borders

It is a system designed to empower the individual. And it’s accessible to anyone with a smartphone and a will to learn.

This is not just a financial evolution. It’s a moral one.

✊ CLAIM YOUR SOVEREIGNTY

This Fourth of July, I’m not just waving a flag. I’m inviting you to consider what real freedom looks like in the 21st century.

If the Declaration was about rejecting kings, Bitcoin is about rejecting gatekeepers.

If the Constitution was about limiting government, blockchain is about limiting control.

It’s not about getting rich—it’s about getting free.

And the journey doesn’t start with buying Bitcoin. It starts with understanding it. With reading. Exploring. Asking questions. Opening your mind to what comes next.

That’s how revolutions begin.

🔓 READY TO TAKE THE FIRST STEP?

🧠 Subscribe to Deven.blog — for insight, education, and exploration at the edge of freedom and innovation.

🌐 Visit CryptoDeven.com — a trusted resource hub for beginners. Learn how to research, buy, and store cryptocurrency. Secure your sovereignty.

🇺🇸 This Independence Day, don’t just celebrate freedom. Practice it.

Great point, Peter. You’re right—Wall Street can play games with Bitcoin through futures and ETFs. They can influence price in the short term, no doubt.

But they can’t touch the protocol.

Bitcoin’s rules don’t change:

21 million supply

Decentralized by design

Anyone can self-custody and use it without permission

That’s the real power. The price might get pushed around, but the freedom is in the code. The more people actually use and hold Bitcoin outside the old system, the less control the institutions have.

Appreciate you bringing this up—it’s an important distinction.

Devin I agree with it conceptually and I believe it would do exactly as you say it would do in theory. However, how do we explain the fact that the institutional guys have created trading vehicles “futures” on Bitcoin and can thus short it or go long it by using derivatives and therefore reducing our ability of autonomy.